Exhibition time: 17-19 March, 2025 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2025 Shanghai, China

中文

中文

Key words of the passage: outlook; fertilizer; supply; outlook

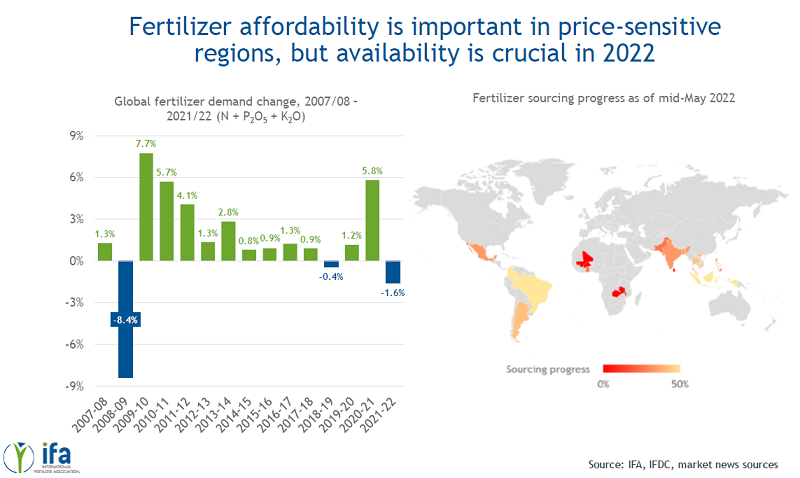

The situation in Ukraine requires a new methodology to assess future fertilizer supply and demand.In traditional market cycles, the balance between fertilizer supply and consumption is most often dictated by cost competitiveness and incentive to produce, resulting in market rationalization which plays out at the industry level. In 2022, with supply shortages and high fertilizer prices, IFA expects the balance between supply and consumption to be dictated by farmers’ ability to source and afford fertilizers. As a result, market rationalization is likely to play out at the farmer level.

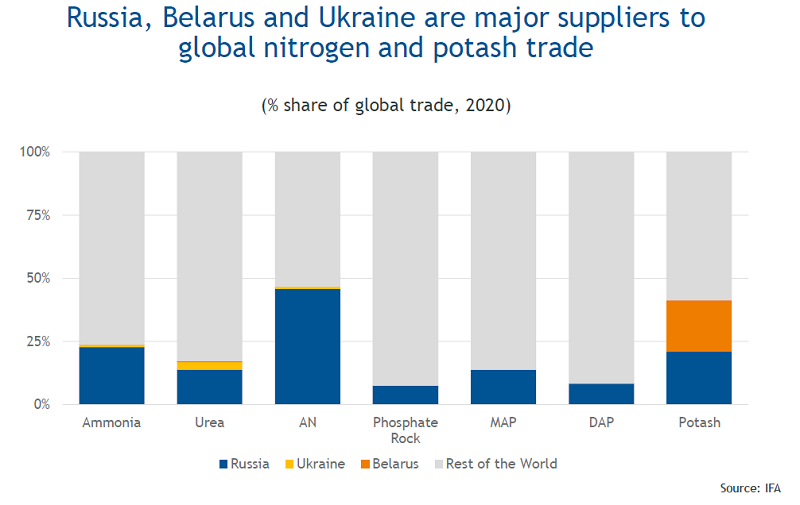

The availability crisis stems primarily from sanctions on two key producing countries. Sanctions were first imposed on Belarus in June 2021 and have since been widened to target the country’s potash sector directly. The majority of potash exports from Belarus transit via Lithuania to reach the Baltic Sea, and with rail lines no longer willing to transport product from Belarus through EU territory, exports to the global market are effectively blocked. Following the conflict between Russia and Ukraine, sanctions have been placed on a number of the war, entities and sectors. Fertilizers are not directly targeted, but financial sanctions have had indirect impacts, and coupled with logistical constraints at Russian ports have reduced the flow of fertilizer exports. The nitrogen (N) fertilizer industry in West and Central Europe is also heavily impacted by reduced natural gas supply from Russia. Other key fertilizer suppliers, namely China, have imposed export restrictions to protect their domestic agriculture in response to the tight global market, which has further reduced supply.

The combined contribution of Russia and Belarus to global fertilizer supply means that there is a distinct probability that there will be a shortfall of certain fertilizers in 2022. Russia and Belarus account for 41% of globally traded potash (K) and are the second and third largest producers respectively. Russia accounts for almost 25% of global N trade, exporting to a diverse number of countries globally. Russia exports smaller volumes of phosphate (P), but the sector is not spared from disruption, because the role of Russia in natural gas and ammonia markets has contributed to record high raw material costs for processed phosphate producers.

Source: IFA