Exhibition time: 17-19 March, 2025 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2025 Shanghai, China

中文

中文

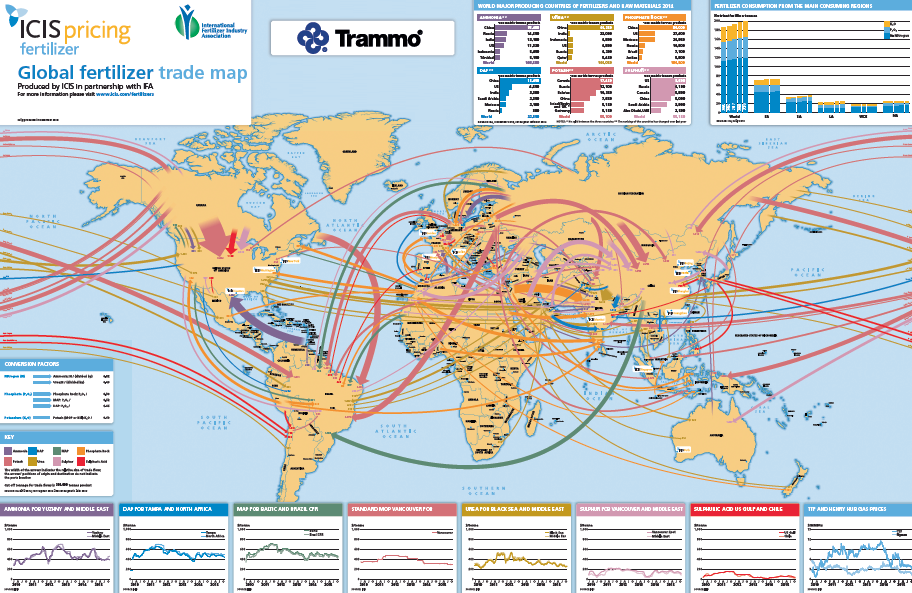

Competition among sellers in the Asian NPK market is set to heat up next year as rising exports from China meet increased domestic capacity within the region.

China, the world's leading NPK producer, ramped up its NPK exports from a low base this year, with this trend looking set to continue in 2019.

But its rising presence within the region is coinciding with greater domestic NPK output in markets including Vietnam, Myanmar, Indonesia and India.

As the world's leading consumer of NPKs, Asia also imports large quantities from Europe and Russia, so these incumbents — such as Norway's Yara and Russia's Acron — will play a part in this increasingly competitive mix. Saudi Arabia's Ma'aden is raising its NPK production and will also likely feature more in Asian markets going forward.

The increased supply options for buyers from next year may cap potential price rises as sellers fight for market share.

China produces over 50mn t/yr of compound NPKs, so its potential to export is substantial. The Chinese government this year cut the export tax applicable on NPKs from 20pc in 2017 to a flat rate of 100 yuan/t ($14.53/t) for 2018. This notable cut contributed to a jump in NPK exports to 320,000t during January-October, up from 40,000t during the same period in 2017, according to Chinese customs data.

Vietnam and the Philippines have been among the recipients taking more Chinese NPKs in 2018, with no sign that this trend of rising Chinese exports will abate going forward.

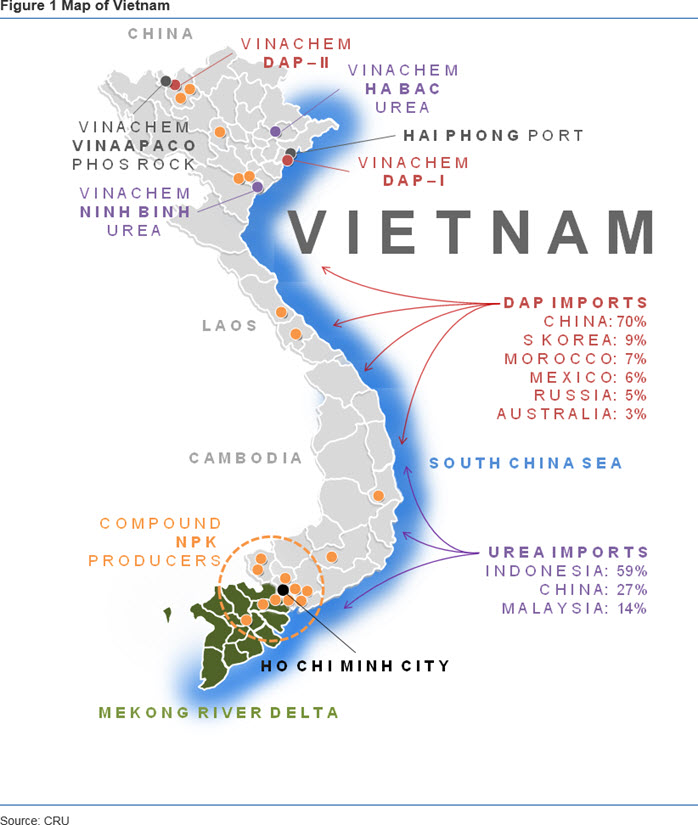

Vietnam expands

Vietnam — one of Asia's largest NPK consumers — is worth looking at in more detail as its production profile is expanding.

State-owned producer Pvfcco started production at a new 250,000 t/yr NPK unit in Phu My in July, following Korea-Vietnam Fertilizer's start-up of a 360,000 t/yr plant in Ho Chi Minh City in late 2017. Vietnamese producer PVCFC will start up a new 250,000 t/yr NPK unit in the first half of 2019, with another NPK unit earmarked for a yet-to-be-confirmed date.

Vietnam imported only 402,530t of NPKs in January-October 2018, according to customs data, despite taking more NPKs from China. This is down from 444,450t over the same period last year and is attributed to increased domestic production. Imports may fall further as more capacity comes on stream.

Indonesia, which traditionally imports NPKs from a range of origins including Russia, Belgium and Norway, is also upscaling its production.

State-owned Pupuk Indonesia, the holding company for various domestic fertilizer manufacturers including Petrokimia Gresik, is aiming to add a total of 2.4mn t/yr of NPK capacity over two phases, bringing the group's total capacity to 5.5mn t/yr. Exact timelines for the expansion project are unclear but likely to be within the coming few years.

Indonesia's NPK imports totalled around 590,000t last year, according to GTT data, suggesting that much of this new capacity could be for export, adding to supplier competition within the region.

India, which traditionally imports around 500,000 t/yr of NPS/NPKs from countries including Russia and Indonesia, is ramping up its domestic production over the coming years, which will likely reduce this import figure over the medium-long term.

Deepak Fertilizers will be adding around 300,000 t/yr of capacity at its Taloja unit next year, bringing total NPK/DAP capacity to around 1.2mn t/yr. It added 600,000 t/yr this year.

Producer MCFL is expected to add around 800,000 t/yr of DAP/NPK capacity in Mangalore over the coming years.

Considering these dynamics, the Asia NPK market is set to become increasingly competitive as supply east of Suez rises because of both higher production and additional exports. The brand loyalty that NPK sellers have traditionally enjoyed — which has differentiated them from the commodity fertilizer sector — will also come under more scrutiny as buyers' options increase.

Source from: Augus