Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Agriculture has played an important role in the economic development of agrarian India with ~17% of the gross value added (GVA) and more than 50% of the population depending on it. In the last 17 years, the all India foodgrain production increased at a compound annual growth rate (CAGR) of ~3% from 175 million t in 2002 – 2003 to 296 million t in 2019 – 2020. With only a marginal increase in acreage, the increase in the productivity levels plays a vital role in the growth of the agriculture industry, as fertilizers account for at least half of the crop yield.

However, while India has the largest area of arable and permanently cropped land in the world, it ranks third in the world in overall foodgrain production after China and the US, primarily due to low crop productivity. With limited arable land and rising food needs, the long-term potential for increase in fertilizer usage is moderately high in India. On the other hand, with the increase in acreage from 16.3 million ha. in FY2002 – 2003 to 25.49 million ha. in FY2018 – 2019 and improved productivity from 8.9 t/ha. to 12.3 t/ha. during the same period, all-India horticulture production increased at a CAGR of ~5% from 144.4 –313.85 t during the 17-year period.

Demand trends for fertilizers

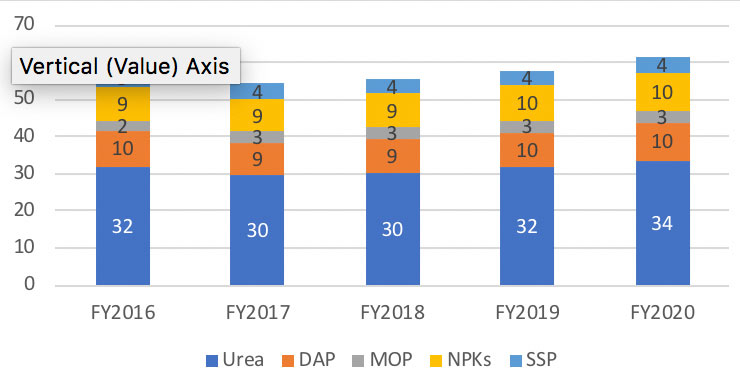

The Indian fertilizer industry can broadly be divided into two categories, depending on the nutrient composition: (i) nitrogenous fertilizers and (ii) phosphatic and potassic (P&K) fertilizers. The overall fertilizer consumption in India has grown at a CAGR of 2.0% from 50.6 million t in FY2009 to 61.4 million t in FY2020. In FY2020, the primary sales volumes for fertilizers grew at a moderate rate of 6.0% to 61.4 million t in FY2020 from 57.8 million t in FY2019, following the healthy monsoons (Figure 1). While urea sales grew by 5.9% to 33.6 million t in FY2020 from 31.7 million t in FY2019, non-urea sales grew by 6.1% to 27.8 million t in FY2020 from 26.2 million t in FY2019.

Figure 1. Trend in fertilizer sales volumes (mmt)

Demand-supply scenario for urea

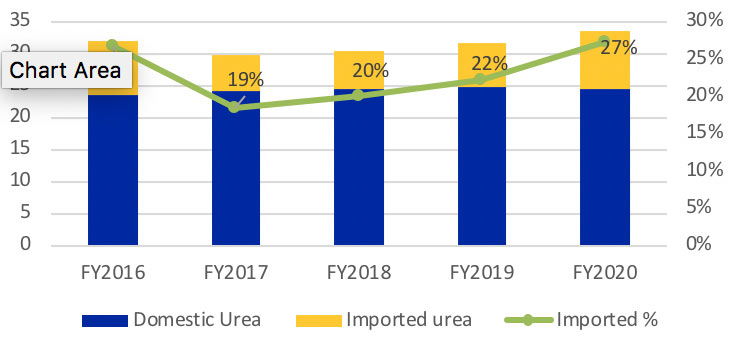

The domestic consumption of urea grew moderately at a CAGR of ~1.3% from 31.9 million t in FY2016 to 33.6 million t in FY2020. Demand for urea remains stable because of the traditionally high usage and also the fact that the freeing up of retail prices for non-urea fertilizers, following the implementation of nutrient-based subsidy (NBS) for these fertilizers, has led to a significant price differential of urea vis-à-vis non-urea fertilizers. With the New Urea Policy-2015 (NUP-2015) measures and the gas pooling policy encouraging the greenfield and brownfield investments in urea, production grew at a CAGR of 1.3% from 23.4 million t in FY2014 to 24.5 million t in FY2020 against the consumption growth of ~1.3% CAGR during the same period. However, domestic urea production remained stagnant at 24.5 million t in FY2020 compared to 24.7 million t in FY2019. Nevertheless, import dependence remains high with ~27% of the urea demand met by imports during FY2020. Imported urea sales witnessed a sharp increase to 9.1 million t as indigenous production was lower vis-à-vis FY2019, as few urea plants remained under shutdown for prolonged periods during the year (Figure 2).

Figure 2. Trend in urea production and share of imported urea in overall consumption.

Demand-supply scenario for non-urea fertilizers

The Indian P&K fertilizer industry works under the NBS scheme w.e.f from 1 April 2010, as per which prices of these fertilizers have been partially deregulated. The performance of the Indian P&K fertilizers industry has remained volatile, post the introduction of the NBS due to economic (such as demand-supply, commodity prices and currency movements) and regulatory (such as subsidy delay) issues. As a result, the domestic consumption of P&K fertilizers has been volatile with volumes fluctuating between 20.6 million t on the lower side and 31.5 million t on the higher side. However, during FY2020, P&K fertilizer sales volumes reported a 6% growth to 27.8 million t, despite imports being lower by 17% since the systemic inventory level at the beginning of the year was high. The imports of DAP and MOP declined 23% and 11% respectively whereas imports of NPK increased by 16% in FY2020. Domestically manufactured P&K volumes remained stagnant with a growth rate of ~1% during FY2020. Import dependence, forex fluctuations, agro-climatic risks and retail price differential of P&K fertilizers vis-à-vis urea continue to remain the key challenges for the P&K industry.

Monsoon trends and impact on fertilizer demand

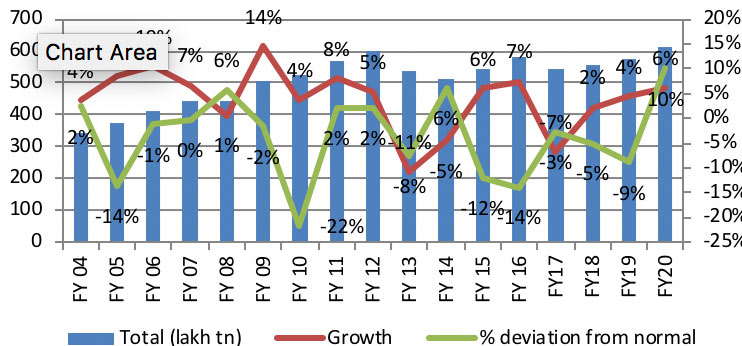

A study of the trends in domestic fertilizer volume growth for the past 15 years (Figure 3) reveals that the correlation of the monsoons and fertilizer sales in the past has not been very high as primary fertilizer sales also depend on other factors like systemic inventory levels, reservoir levels and soil moisture levels. During 2019, the South-West monsoons were favourable and reported at 110% of its long period average. In the current year, the reservoir levels in certain key areas have been significantly higher than levels in 2019 and vis-à-vis the 10-year average levels. Moreover, the rainfall in the current monsoon season, i.e. kharif season of CY2020 has been predicted to be normal. As a result, kharif sowing is early and higher than the previous year.

Figure 3. Trend in fertilizer sales volume and monsoon deviations.

Raw material/feedstock

Natural gas is used as feedstock and fuel in the urea sector, forming ~70 – 80% of the cost of production of urea, depending on feedstock prices and the energy efficiency of the plant. Out of the 32 urea plants in India, 29 are gas based. The total gas consumption of all these plants was 42.2 million m3/d in 2019 – 2020, out of which about 17.3 m3/d is being supplied through domestic sources, and the rest through imported R-LNG. With domestic production of natural gas not witnessing material growth and priority of the allocation of the same being shifted to the city gas distribution (CGD) sector, the share of R-LNG in the overall consumption mix has witnessed an increase over the last couple of years for the Fertilizer industry. For FY2020, the share of R-LNG increased to 59%, up from 49% in FY2017. This leads to a higher urea production cost and hence a higher subsidy burden for the government of India (GOI)/industry.

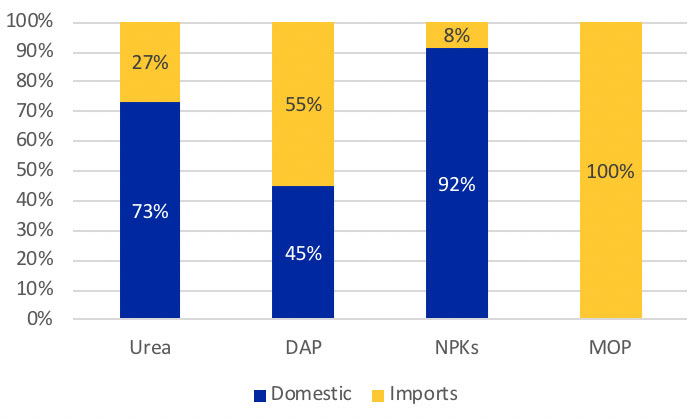

The P&K fertilizer industry is highly dependent on imports, even while India has large manufacturing capacities of DAP and NPK fertilizers. The MOP is entirely imported (Figure 4). India imports significant quantities of key raw materials like rock phosphate, phosphoric acid and ammonia. Also, with a limited number of global suppliers, the bargaining power of the Indian fertilizer players with these suppliers is limited to a certain extent. Thus, the industry faces both availability and pricing issues for key raw materials on a regular basis.

Figure 4. Imported vs domestic mix for key fertilizers in FY20.

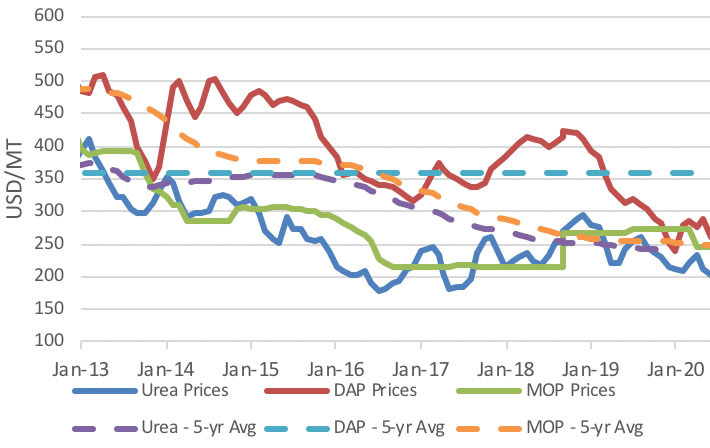

The DAP prices have been on a downtrend since the beginning of CY2019, remaining significantly below the 5-year average of US$359/million t as raw material prices have remained weak from new capacities in Saudi Arabia. The DAP retail price moderated in FY2020 as the industry passed on the impact of the softening raw material prices to the farmers. (Figure 5).

Figure 5. International price trends for urea, DAP and MOP.

Profitability of major incumbents

The Indian fertilizer industry sells products to farmers below their cost of production and is eligible for subsidy from the GoI for notified fertilizers. The total realisation thus comprises subsidy and a farm gate price (maximum retail price [MRP]). However, the decomposition of realisation is different for urea and non-urea fertilizers.

Urea farm gate prices are fixed by the GoI, and the subsidy varies in line with the feed and fuel prices to ensure a normative fixed return (post tax 12% return on equity [RoE]). On the other hand, in case of non-urea fertilizers (viz. DAP, NPK, MOP), the subsidy is fixed for 1 year, and the players are free to fix their own MRP in line with the raw material prices.

Profits for urea players

While the Indian urea industry witnesses a favourable demand-supply scenario, the returns for the manufacturers have been under pressure in recent years due to lack of timely revisions in normative costs as part of the subsidy framework and subsidy delays. The operating margins of the industry have remained modest over the past few years due to an increase in the cost base. The aggregate debt-equity ratios have also remained relatively high due to the working capital-intensive nature of the industry, primarily due to high subsidy receivables. Moderate returns and high gearing levels also lead to modest coverage indicators. With subsidy delays likely to continue, leading to high working capital borrowings, the financial performance of the industry is expected to continue to remain modest over the medium term.

The only way urea players can expect to see profits in excess of a 12% RoE is by outperforming the normative cost parameters. The players have tried to achieve the same by:

- Achieving lower-than-normative energy consumption (measured in GCal/t for production of urea) by taking up energy-saving/conversion projects.

- Operating the plant consistently above the normative capacity utilisation level.

- Undertaking debottlenecking projects and producing beyond the cut-off capacity to earn import parity pricing (IPP)-based realisations.

From Agropages