Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Key words of the passage: fertilizer; price; supply; demand

Global fertilizer prices are at near record levels and may remain elevated throughout 2022 and beyond. Fertilizer prices account for nearly one-fifth of U.S. farm cash costs, with an even greater share for corn and wheat producers. Fertilizer accounts for 36 percent of a farmer's operating costs for corn, and 35 percent for wheat. These elevated prices could have implications for crop production in 2022 and 2023.The conflict between Russian and Ukraine has exacerbated the already limited fertilizer supply situation and has triggered import-export restrictions that will compound shortage concerns.

The United States is a significant producer of nitrogen and phosphorus yet imports large quantities of potassium-based fertilizers. Although fertilizer prices began increasing in 2021, many U.S. producers were able to avoid the later surge in fertilizer prices caused by the conflict between Russian and Ukraine, because fertilizers for 2022 plantings were purchased in 2021. However, as the Russia-Ukraine war continues, the impact of fertilizer prices could likely take a heavier toll on 2023 agricultural production decisions, domestically and abroad.

This report examines the global fertilizer landscape, with a focus on the three main macro-fertilizer groups—nitrogen, phosphorus, and potassium (NPK). We look at (1) the major suppliers; (2) the major users; (3) the major exporters and importers; (4) the impact of the conflict between Russian and Ukraine; and (5) discuss how the United States fares relative to other countries.

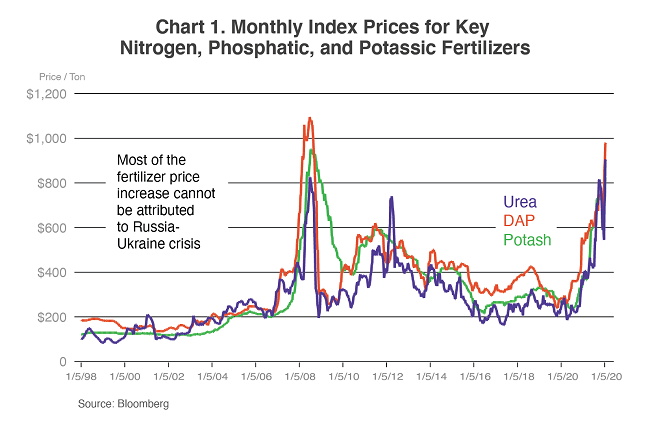

Current fertilizer price increases are reminiscent of the Great Recession period (Chart 1), when prices nearly doubled across all major fertilizer groups at the end of 2007. At that time, fertilizer prices were fueled by rising demand in many emerging markets, increased use of corn and other crops for biofuel production in the United States, Brazil, and Europe, the surge in energy prices, and Chinese fertilizer export tariffs. However, fertilizer price increases during the Great Recession were short-lived once the demand for fertilizer fell, due to a decline in global agricultural trade coupled with slowing economic growth and low commodity prices.

Much like the period of the Great Recession, similar issues have fueled higher fertilizer prices in 2022. Global fertilizer demand remains strong. Some countries have reduced their fertilizer use since 2007, but many have continued to increase their crop nutrient use. While the United States’ share of global fertilizer demand has dropped from 20 percent to 10 percent since 2007, many of the emerging markets have stepped up their use of fertilizers.

The surge in natural gas prices in the middle of 2021, especially in Europe, resulted in a reduction in producing ammonia—a key input of nitrogen fertilizer production. Coal price increases in China also led to a rationing of electricity usage, causing some fertilizer production plants to decrease production. This resulted in China imposing a quota on fertilizer exports, particularly phosphates, until June 2022, citing the need to ensure domestic availability and food security. China’s suspension of fertilizer exports significantly diminished the global supply.

Numerous factors have worsened existing supply chain disruptions caused by COVID-19. These include export restrictions enacted by Russia and China, plus international sanctions on Belarus and on Russia. Russia and its ally, Belarus, are both major fertilizer suppliers to the global market. Recently, many countries have imposed restrictions on Russian imports. In response, Russia imposed initial restrictions on nitrogen and complex nitrogen fertilizer exports through June 2022. As of May 23, 2022, the Russian government increased the current six-month quotas on some fertilizer exports. Thus, expanding nitrogen fertilizers by 231 thousand tons to 5.7 million tons, and expanding complex or compound nitrogen-containing fertilizers by 466 thousand tons to 5.6 million tons. A decree released on June 1, 2022, codified the Russian government’s intent to maintain fertilizer export quotas through the end of 2022. Supply issues may contribute to elevated fertilizer prices for a prolonged period, as the conflict between Russia and Ukraine continues.

Source: USDA Foreign Agricultural Service

Previous: Where and How are Fertilizers Used?