Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Key words of the passage: fertilizer; supply; forecast; capability

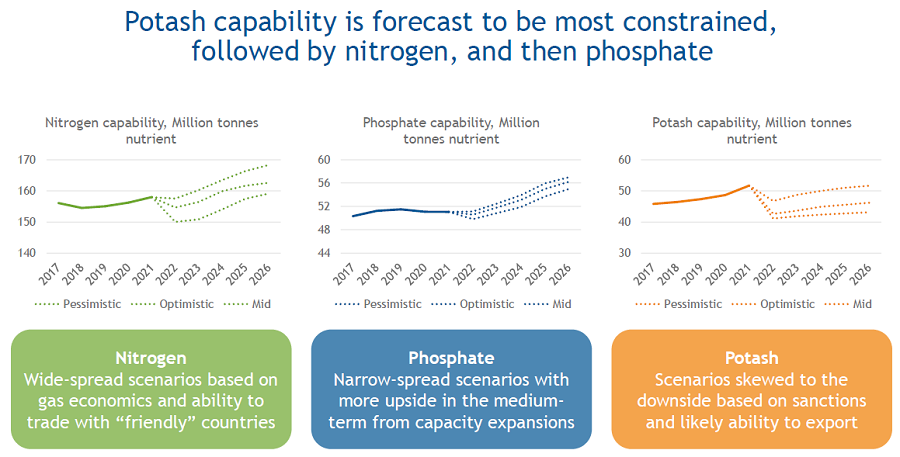

As a trade association, IFA is prohibited from forecasting future output levels of the industry. Instead, the Market Intelligence Service forecasts a supply measure known as capability, which combines announced capacity developments and an adjusted effective operating rate based on historical trends. This results in a forecast designed to reflect potential supply based on fixed assumptions. The supply forecast starts by considering projects to build new capacity or expansions at existing sites, collected by surveying IFA members on their capacity investment plans.

The three nutrients have different levels of exposure to new supply from Russia and Belarus, based on investment in these countries. For nitrogen, almost one-third of the forecast capacity expansions between 2022 and 2026 are located in Russia or Belarus. This is similar to the share that was commissioned in the last five years, given the low cost of gas and favorable export positioning of the two countries.

The phosphate industry is the least exposed to capacity expansions in affected countries, because while around a quarter of new capacity between 2017 and 2021 was located in Russia, capacity expansions in the next five years to 2026 are located entirely outside of sanctioned countries (in Africa and East Asia).

Potassium is by far the most exposed nutrient to capacity disruptions, with more than 80% of forecast expansions located in Russia. There are some largescale projects not yet included in IFA’s forecast, such as BHP’s Jansen mine in Saskatchewan, Canada, but even in a best-case scenario, these projects are likely to become operational in 2026 at the earliest.

In order to generate supply scenarios for each nutrient, the following adjustments were made. Nitrogen capability was adjusted in Russia, Ukraine and Belarus, based on the ability of these countries to export amid international sanctions on Russia and Belarus, and logistics issues from Ukraine. Capability of West and Central Europe was also adjusted based on disrupted natural gas supply from Russia. In the optimistic scenario, a modest decline in nitrogen capability of 0.3 Mt N is forecast in 2022, while the pessimistic scenario suggests a 5.7 Mt N reduction. The middle ground scenario results in a capability forecast 2.4 Mt N lower than in 2021. Between 2023 and 2026, global capability is forecast to improve across all scenarios, ranging from 113.4 Mt N to 120.0 Mt in 2026, up from a base of 112.6 Mt N in 2021.

Phosphate capability was adjusted based on Russia’s ability to export, and in Europe based on ammonia raw material costs, and the operational ability of the Russian-owned Lifosa plant in Lithuania. In the optimistic scenario, global phosphate capability is forecast to be stable compared to 2021. In the pessimistic scenario, a decline of 1.2 Mt P2O5 is forecast, while the middle ground scenario results in a 0.4 Mt P2O5 reduction in 2022. In the medium-term, phosphate capacity growth was already forecast outside of the Eastern Europe and Central Asia (EECA) region. Global capacity is forecast to increase across all three scenarios, growing from 48.9 Mt P2O5 in 2021 to between 50.7 Mt and 52.7 Mt P2O5 across scenarios in 2026.

Potash capability was adjusted in Russia and Belarus based on ability to export, including a view on overland trade from Belarus to China and via Russia. In the optimistic scenario, potash capability is forecast to be 4.1 Mt K2O lower than in 2021, the middle ground scenario is 7.6 Mt K2O lower, and the pessimistic scenario is almost 9 Mt K2O lower in 2022. Potash capability is forecast to remain below 2021 levels in all scenarios over the next five years, due to the high exposure to Russia and Belarus, and the relatively slow process to wind down sanctions even in an optimistic case. This results in global potash capability forecast at between 36.0 Mt and 43.2 Mt K2O in 2026, compared to a capability measure of 43.2 Mt K2O in 2021. As a result, nitrogen fertilizer consumption is expected to be dictated by a mix of availability and affordability constraints. Phosphate consumption is forecast to be constrained by affordability, while potash consumption is likely to be heavily constrained by availability.

Source: IFA