Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Key words of the passage: fertilizer; demand; consumption; outlook

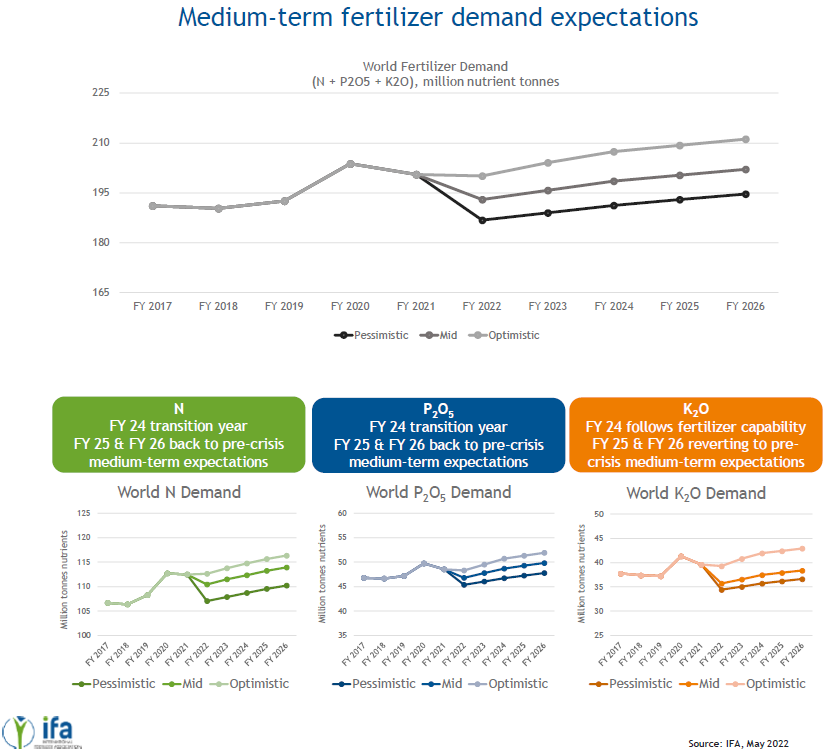

In the medium-term (FY 2024 to FY 2026), global fertilizer demand is expected to continue its recovery, differentiated by scenario:

• In the pessimistic scenario, global fertilizer demand reaches 194.6 Mt nutrients in FY 2026, 2 Mt above FY 2019 but 9 Mt below the FY 2020 level.

• In the mid scenario, global fertilizer demand reaches 202.1 Mt, 9.5 Mt above FY 2019 but 1.7 Mt below FY 2020 level.

• In the optimistic scenario, global fertilizer demand would reach 211.1 Mt, 7.4 Mt above the FY 2020 level.

Trends in potassium consumption are expected to slow the recovery of total fertilizer use. Under the pessimistic scenario, global potassium consumption would reach only 36.6 Mt in FY 2026, or just above the level reached 10 years before (36.2 Mt in FY 2016) and well below the FY 2020 record level of 41.3 Mt. Under the mid scenario, global potassium consumption would reach 38.3 Mt in FY 2026, above the FY 2019 level (37.2 Mt) but still well below the FY 2020 record level. Only under the optimistic scenario would global potassium consumption exceed the FY 2020 level by the end of the outlook period.

Global nitrogen and phosphorous consumption would also lag behind under the pessimistic scenario and remain below the FY 2020 record levels by the end of the outlook period. However, under the mid and optimistic scenarios, global nitrogen and phosphorous consumption would grow more quickly and exceed the FY 2020 record levels by FY 2026.

Under the pessimistic scenario, East Asia and South Asia are forecast to drive the global decline between FY 2021 and FY 2026. Under the mid and the optimistic scenarios, Latin America is set to drive global growth over the five-year period.

Compared to IFA’s previous medium-term demand forecast (published in July 2021), South Asia slipped down the list of contributors to global growth due to an expected sharp decline in FY 2022. Africa would also be a much smaller contributor to global growth than expected in the past.

Source: IFA