Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

India consumes 35 million tonnes of urea annually. Domestic production has risen impressively from 22.5 million tonnes in 2014 to 31 million tonnes in 2024.

The Talcher Fertiliser Plant, the country’s largest and first coal gasification-based urea facility, is expected to start operations by the end of 2024. After its commencement, domestic urea production will be around 32.5 million tonnes.

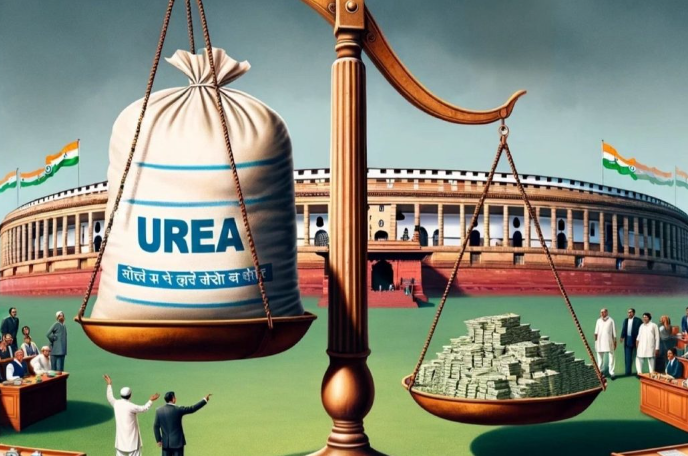

Thus, the country’s urea import dependence should not exceed 2.5 million tonnes. By educating farmers to use urea more wisely and introducing new products like Nano Urea, the government of India plans to close this gap of 2.5 million tonnes and become urea self-sufficient by 2025. These are really big plans, but who is really subsidizing them?

As is widely known, the present Indian government has guaranteed that urea will be available for farmers at INR 242 per 45 kg bag. That’s roughly $3 per 45 kg bag or, let’s round it, $70 per metric tonne.

India’s domestic natural gas production increased by 2.4% annually on average between 2019 and 2022, while imports declined by 1.5% annually. However, the country is still heavily dependent on imports. Today, as my fellow producer said, imported gas is sold to urea producers at $16 per MMBtu.

Typically, producing one metric tonne of urea requires about 28-32 MMBtu (million British thermal units) of natural gas, considering the energy needed for both the synthesis of ammonia and the subsequent conversion to urea. Assuming an average consumption of 30 MMBtu per tonne of urea, the cost of natural gas would be 30 MMBtu x $16 per MMBtu = $480 per metric tonne. If an Indian import tender were held today, the price of imported urea would be around $350 per metric tonne CFR India. This is a substantial difference.

$16 per MMBtu equals €50 per MWh, which is 100% higher than last week’s European price of €25 per MWh and significantly higher than the usual “Asian premium” of €6-7 per MWh.

So, if the Indian government delivers gas to local urea producers at such a high price, it is indirectly a kind of rent or duty, which is later distributed in favor of urea consumers. However, by subsidizing farmers, the government essentially harms local urea producers, depriving them of any possible production margins.

Now, please tell me—how does the Indian government plan to achieve urea self-sufficiency? Something must change in this chain.

To achieve urea self-sufficiency, the Indian government should shift its subsidy strategy. Instead of subsidizing inputs like gas, subsidies should be given to the crops. This ensures direct farmer support, encourages market efficiency, and reduces the fiscal burden. By focusing on crop subsidies and allowing market-based input pricing, they can promote sustainable and efficient urea production while effectively supporting farmers.

Indian parliamentary elections were held on June 4, 2024. The new government will be formed by the middle of June. It will be interesting to see its moves towards fertilizer subsidies and local production, but I do expect changes.

About the Author of “Friday’s Insider”: Ilya Motorygin is the co-founder of GG-Trading and brings 30 years of experience to the fertilizer industry. Renowned for his comprehensive problem-solving skills, Ilya expertly manages deals from inception to completion, overseeing aspects such as financing, supply chains, and logistics.

From:FertilizerDaily