Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

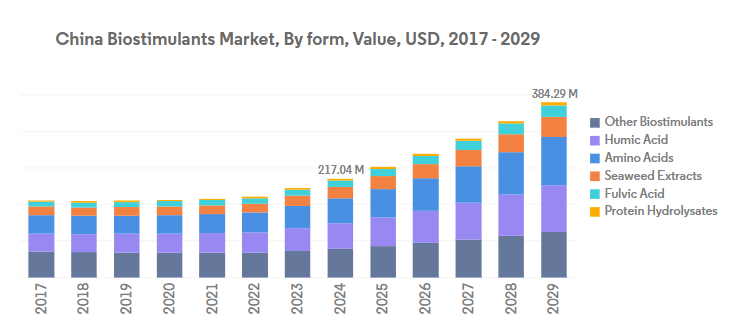

The China Biostimulants Market is segmented by Form (Amino Acids, Fulvic Acid, Humic Acid, Protein Hydrolysates, Seaweed Extracts) and by Crop Type (Cash Crops, Horticultural Crops, Row Crops). The report offers market size in both market value in USD and market volume in metric ton. Further, the report includes market split by form and various crop types.

China Biostimulants Market Size

China Biostimulants Market Analysis

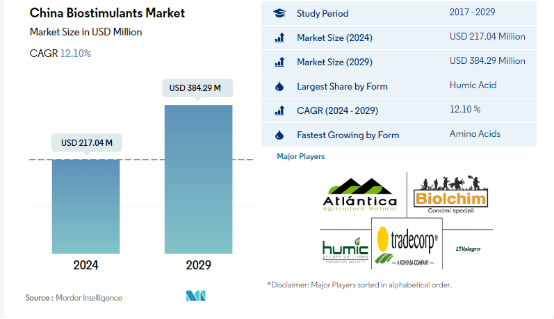

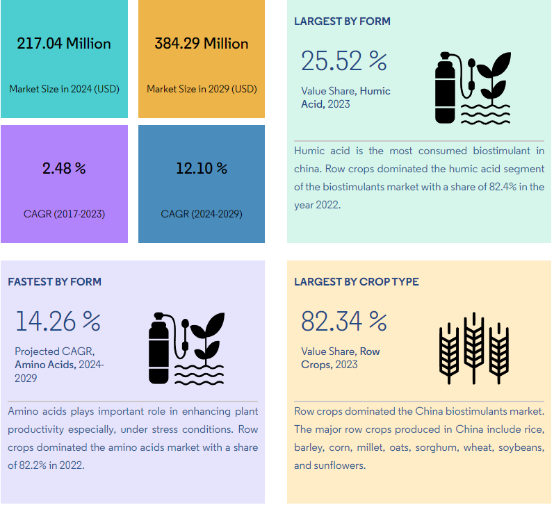

The China Biostimulants Market size is estimated at 217.04 million USD in 2024, and is expected to reach 384.29 million USD by 2029, growing at a CAGR of 12.10% during the forecast period (2024-2029).

·The biostimulant market in China consists of many active ingredients such as humic acid and fulvic acid, amino acids, protein hydrolysates, seaweed extracts, and other biostimulants like organic plants and animal derivatives.

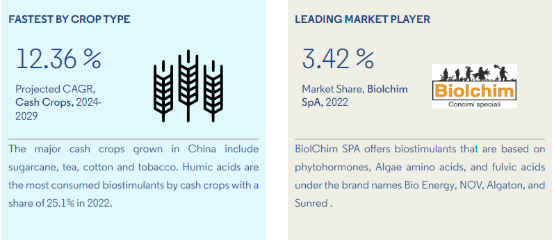

·In 2022, humic acid dominated the Chinese biostimulants market, accounting for about 25.2% and 28.9% of the total market by value and volume, respectively. Humic acid helps improve the root system of crops such as soybean, wheat, rice, and maize; vegetable crops such as potato, tomato, cucumber, and pepper; fruit crops such as citrus (Citrus limon) and grape (Vitis vinifera). Humic acid promotes shoot growth in crops like cucumber, tomato, leeks, peas, wheat, maize, and pepper.

·In China, amino acids accounted for 24.2% of the total biostimulants market value in 2022. The consumption volume of amino acid biostimulants is expected to increase by 49.1% between 2022 and 2029, from 5.0 thousand metric tons in 2022 to 7.4 thousand metric tons in 2029. This is mainly due to the increasing trend in adopting sustainable or organic agriculture in the country.

·Seaweed extracts accounted for 11.3% of the Chinese biostimulants market in 2022. Seaweed extracts biostimulants are expected to witness the fastest growth rate compared to other types of biostimulants as seaweed biostimulants can be prepared in a circular and sustainable way and can be mixed with other ingredients as a part of fertilizer. They offer specificity of action to improve the yield of crops.

·Despite the potential positive effects on different crops, there is little knowledge of the impacts of biostimulants on commercially grown crops like citrus and strawberry and vegetables like tomato and capsicum.

China Biostimulants Market Trends

Country’s zero growth in pesticides use and increasing exports under organic products driving the organic cultivation.

·According to the latest reports by FiBL and the IFOAM, the market for organic food in China is growing at an annual rate of 25.0%. The shift from conventional to organic is a transformation toward a more sustainable food system within China, given the USD 2.91 billion of agri-food commodities exported from China each year.

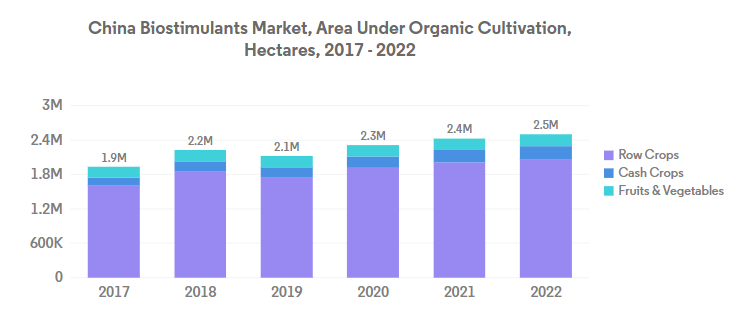

·The size of organic farmland increased rapidly in China because more people started buying organic products due to increased incomes and the increasing importance of food safety. In the last three years, China's organic planting area increased by 10%, reaching 2.4 million ha in 2020. In addition, national policies have been adopted to promote organic production, advocating the slogans that state, ″lucid waters and lush mountains are invaluable assets″ and ″green development".

·Organic farming in China is majorly export-oriented. The products that are both exported and imported include cereals, soybeans, fruits, and vegetables. China's three northeastern provinces (Liaoning, Jilin, and Heilongjiang) support the largest organic production nationally in terms of output, volume, and area. Most organic farms located in the northern part of China (e.g., Shandong and Liaoning) supply organic vegetables and fruits to nearby cities. In addition, they export some products to Japan, South Korea, Europe, and the United States.

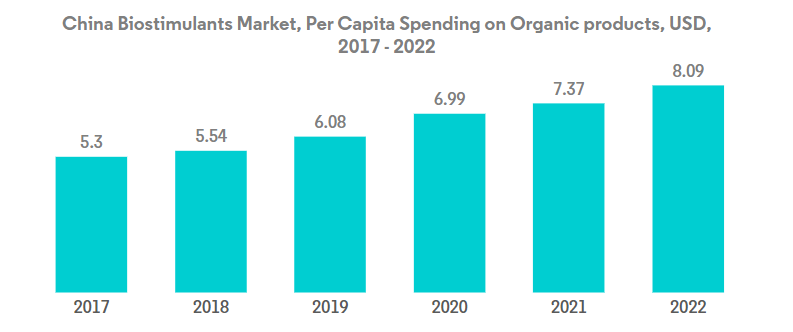

Approximately 73% of Chinese consumers willing to have organic food

·China's organic food market is developing rapidly, and the potential demand for organic food among Chinese consumers is enormous. This is due to the growth of the wealthier middle classes and a greater awareness of the health implications. In 2021, organic food sales in China amounted to about USD 77.54 billion.

·Due to various government laws that favor organic food over food safety and customer preferences for organic food over conventional food, the demand for organic food items has considerably expanded. While prices of organic vegetables in China range from 3 to 15 times the cost of conventional produce, prices for organic vegetables are generally between 5 and 10 times that of their conventional counterparts. However, despite the price factor being a barrier, wealthy families and individuals with health problems are eager to increase their budget, with approximately 73% of Chinese consumers willing to pay extra for organic foods.

· Although China's organic food sector is still quite small and falls far short of satisfying domestic and international consumer demand, it can be stated that organic food in China has enormous potential in both the domestic and foreign markets, considering the rise in domestic sales by 4.01% in 2021.

Source From:Mordor Intelligence