Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

The Brazilian biologicals market has experienced rapid growth over recent years.

With increasing environmental awareness, popularizing sustainable agriculture concepts, and strong government policy support, Brazil is becoming an important market and innovation center for global biological agri-inputs, attracting international biological companies to expand their operations.

This article addresses the following questions: What changes have occurred in the Brazilian biocontrol and biostimulant market? What policies has the Brazilian agricultural sector introduced to promote the development of the biologicals market? What recommendations exist for companies that have entered or are preparing to enter the country's market?

The information presented is based on reports from Wu Yuhong, Director of Crop Subscription Services at Kynetec, and Alessandro Cruvinel, Coordinator of Brazil MAPA’s National Bio-inputs Program.

These reports were presented at the Biopesticides, Biostimulants and Biofertilizers Summit (BioEx 2024) organized by AgroPages.

Status of the Brazilian biocontrol market

Brazil's crop planting area reached 81.982 million hectares in 2023, with the most significant crop soybean, accounting for 52% of the total, followed by winter corn, sugarcane, and summer corn.

Biocontrols still represent a small portion of Brazil’s entire crop protection market, but their growth rate is remarkable. In only five years, their market share increased from 1% in 2018 to 4% in 2023, with a CAGR of 38%, far exceeding the 12% CAGR of chemicals. In 2023, the country's biocontrol market (farmer consumption) reached US$808 million.

Regarding crops, soybean biocontrols account for the highest share of the entire biocontrols market value, reaching 55% in 2023. Soybean also has the highest proportion of planting area treated with biocontrols, with 88% of the area using such products in 2023. Winter corn and sugarcane are the second and third largest crops, respectively, in terms of market value. The market value for these crops has maintained an upward trend over the past three years.

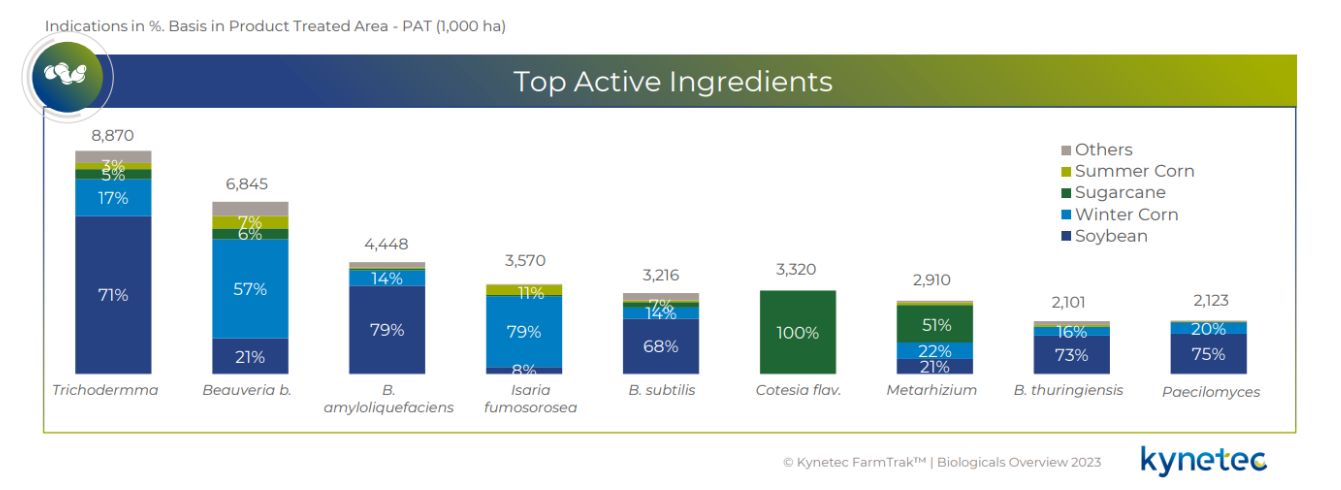

Regarding application areas, the following figure illustrates the nine most widely used active ingredients, percentages in product treated area, and their cumulative annual treated area. Trichoderma is the most prevalent active ingredient, treating 8.87 million hectares of crops annually, primarily for soybean. Beauveria bassiana follows, treating 6.845 million hectares, mainly used on corn. Among the nine primary active ingredients, eight are microbial agents, and Cotesia is the only natural enemy insect applied on sugarcane. The popularity of these active ingredients can be attributed to:

Trichoderma, Beauveria bassiana, and Bacillus amyloliquefaciens: Over 50 manufacturers ensure good market coverage and supply.

Isaria: Substantial increase due to rising corn leafhopper incidence, with treated areas expanding from 11 million hectares in 2021 to 30 million hectares in 2024 on winter corn only.

Cotesia: Long-standing position in sugarcane to control borers.

Paecilomyces: Rapid growth due to nematode infestation and the deregistration of Carbofuran, the main chemical pesticide for nematode control.

Reasons for the rapid growth of the Brazilian biocontrol market

The Brazilian biocontrol market is experiencing rapid growth due to several key factors. Increasing pest resistance has made biocontrols essential tools for integrated pest management. There is a growing emphasis on sustainable agriculture, which has boosted the demand for these products. Additionally, more companies are entering the market, producing and registering biocontrol tools, improving product supply and market share. From a regulatory standpoint, Brazil's biocontrol registration process is significantly shorter than that of chemical pesticides, further facilitating market growth.

Challenges in Brazilian biocontrol market and recommendations for players

Despite its growth, the market faces several challenges. Compared to chemicals, biocontrols have a shorter shelf life, and their efficacy is not immediate. Many growers, mainly traditional farmers, lack confidence in these products. Furthermore, most mainstream products lack differentiation, and biofungicides face significant market entry challenges.

It is recommended that players in the industry focus on strengthening product stability research and extending product shelf life to address these issues. Product developers can also prioritize innovation, developing products that are different from the existing ones and building strong brands that stand out in the market. Educating growers is crucial to enhance their understanding and acceptance of biocontrols.

Status of the Brazilian soybean biostimulant market

The biostimulant market shows promising trends using soybeans as a representative crop due to its largest planting area. The proportion of soybean area treated with biostimulants has increased significantly, rising from 28% in 2020 to 39% in 2023. Farmers also use biostimulants more frequently each planting season, a favorable trend for product providers. The cost of biostimulant application on soybeans has increased, and the market value has doubled since 2020, reaching US$222 million in 2023.

Regarding application methods, foliar spray is the primary way for soybean biostimulants, accounting for 87% in 2023, while soil treatment accounts for a smaller proportion.

Regionally, the most extensive application areas are in Goiás, the Federal District, Minas Gerais, and São Paulo, with usage in these areas increasing over recent years. Companies looking to develop in the soybean biostimulant market may focus on these high-use regions to expand their business.

Brazilian MAPA's support policies for the biologicals industry

Beyond registration regulations, the Brazilian Ministry of Agriculture, Livestock and Food Supply (MAPA) has implemented numerous policies to promote industry development.

In 2020, the government launched the Brazilian National Bio-inputs Program to expand the adoption of biological products and promote sustainable agriculture. The Strategic Council leads this program and comprises representatives from various sectors, such as the Ministry of Environment, farmer representatives, industry representatives, and organic production representatives. The program has established a legal framework addressing different areas, such as investment in science, technology and innovation, quality and production and promotion, knowledge and training, biofactories implementation, and sub-national programs.

Taking investment as an example, such support is especially beneficial for universities and private enterprises lacking funds for new product development. The MAPA also invests in BioFabLabs, which has more biofactories to conduct trials to develop new products. They are creating a network and supporting the construction of BioFabLabs. There are now five BioFabLabs in Brazil, benefiting researchers, students and the private sector.

The federal government provides financial support for local bio-input programs. The local governments know the specific needs and challenges in their regions. This support helps effectively address difficulties faced at the local level.

Additionally, the SEASON PLAN launched by the federal government offers credit to small and medium-sized farmers, supporting the on-farm production of biofertilizers and biocontrol products and the purchase of such agri-inputs.

The Brazilian National Bio-inputs Program also launched an app called Bioinsumos, which displays biocontrol products registered in MAPA. More than 600 biologicals are registered in Brazil and about 100 new products have been registered annually over the past three years. The app is currently being developed into a bilingual version in Portuguese for broader accessibility.

The ministry also provides training on biological products, supported by researchers from Embrapa. Two types of certificates can be issued: one for "Quality control in bioinputs", and another for "Soil health and BioAS (bio-soil analysis) technology".

Brazil has established Bioinputs Innovation Network to find out how many microbial collections they have in the country. This network features an electronic platform connecting all samples and is linked to the interactive platform CATALISA HUB, where users can login and access their microbial collection. It promotes innovation by utilizing biodiversity and transforming resources into final products, connecting private companies, universities, Embrapa and other institutions, and welcoming more participants.

Brazil also has strategic studies about replacing chemical fertilizers with bioinputs. It has established the ABC+ PLAN connected to low-carbon agriculture, incorporating bioproducts to expand their use while reducing carbon emissions and addressing climate challenges.

In collaboration with other MERCOSUL countries, Brazil is participating in the SGT 8, sub-working group of agriculture entirely focusing on bioinputs. Argentina, Brazil, Paraguay and Uruguay are working on developing strategies and understanding how they can harmonize concepts and communicate for the sustainability of agriculture.

Finally, Brazil plans to launch a new platform for agri-tech startups and investors this year. The platform will be in Portuguese and English. It aims to connect investors interested in Brazil with startups, helping them discover innovative technologies with potential. There are nearly 2,000 startups, with bioproduct companies representing a significant proportion in Brazil.

Biologicals market outlook

Kynetec predicts continued rapid growth for the Brazilian Biologicals market with the following outlook:

The growth rate of the Brazilian Biologicals market will significantly outpace that of chemicals.

Big companies are investing in biofungicides, which is expected to accelerate their market growth.

Significant growth opportunities are anticipated in corn bionematicides.

Biological seed treatment on Corn will also start ramping up.

Consolidating the recently acquired companies by the big companies and investments from private equity will help maintain the growth pace.

The relevant policies, product supply and end-users drive the rapid development of Brazil's biologicals sector. This trend represents a win-win sustainable development for food safety, the environment, consumers, farmers and companies, providing an inspiring example for global agricultural development.

Source:AgNews