Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

RFD-TV reported at the end of this past week that "the ag sector is keeping a close eye on the fertilizer market amid tensions in the Middle East. Global nitrogen values started to rise following events earlier this week, which comes following months of tight supply."

"The story this week has been the Iranian attack on Israel," Josh Linville, the vice president of fertilizer for Stone X Group, told RFD-TV. "Of course, we all know how important the Middle East region is to fertilizer production in general but especially to the Nitrogen sector. However, when you look at this attack, it didn't have any impact to any shipping lanes, it didn't have any impact on fertilizer production, yet prices rose. The attack was the trigger that caused the market to finally say, 'Yes, this tight supply situation we've been fighting with, we're now going to finally start to show it in price form.' "

"If we start to see that become a wider conflict, if now all of a sudden we start to see shipping lanes within the Persian Gulf, or we start to see production within the Middle East start to be impacted, its really hard to say where prices go to," Linville told RFD-TV. "The only thing you can say is they will be higher, just at what level do they actually get to. It's a dangerous situation and one we're kind of watching every single day."

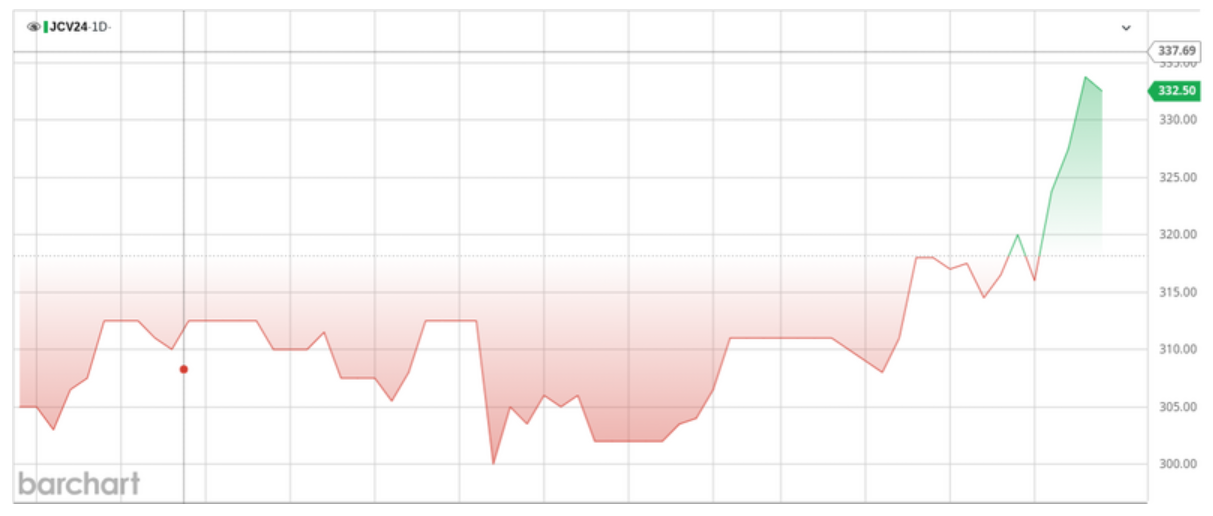

Urea FOB US Gulf Oct ’24.

Bronwfield Ag News' Jared White reported that Linville said that "Iran's attack this week on Israel adds to an already volatile urea market that's seen many countries severely reducing export. 'All of these add up to a situation where urea is very, very tightly supplied.' he says, 'Any sort of gap we might have had between global supply and global demand has been completely destroyed, and now prices are finally starting to reflect that. And we're now starting to see anhydrous and UAN values follow suit.' "

"He tells Brownfield any regional conflict in the Middle East would have a major impact on the global fertilizer market," White reported. "'It is hard to overstate how important it is for fertilizer production across the board.' He says, 'Looking specifically at urea, if you look at North Africa and the Middle East region just as one whole, one out of every two tons of urea exports from that little part of the map.' "

"Linville says urea barge load prices are up 10% this week, and he says farmers planning fall or spring fertilizer applications should be having conversations with their retailers on a regular basis," White reported.

The New York Times' Sarah Kessler and Tania Ganguli reported that Michael Brown, a senior research strategist at the Australian brokerage Pepperstone said that "'I think it's pretty clear that investors are already hedging their risk exposure,' pointing to indexes that measure how much investors are buying options to limit their losses."

"Stephen Schork, a trader who advises heavy industrial users of oil, like fertilizer or natural gas companies, on how to hedge risks, says it's 'imperative to act now' to protect against a jump in prices," Kessler and Ganguli reported.

Source:AgNews