Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

As the world adjust to a new reality, there are few economic impacts from which farmers have been spared. A fast planting season is coming to a close in many areas in the U.S. Consider these financial and input factors as you look towards the summer months.

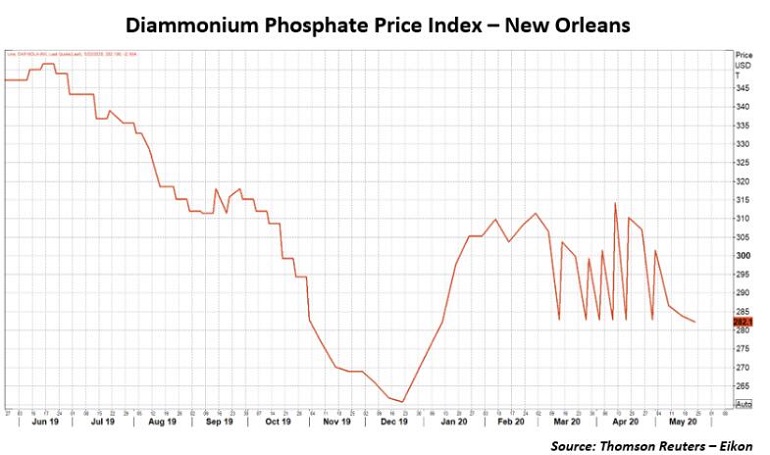

Low fertilizer prices…for now

Phosphate: Wholesale phosphate prices are nearly 19% lower than last planting season though retail costs are slightly higher, reflecting sourcing issues due to China’s lockdown early in the year. But the price difference likely matters little – phosphate application was the first cost cut in spring applications for farmers concerned about commodity prices in the COVID-19 era, according to agronomists.

Anhydrous Ammonia: Anhydrous prices have hovered around $504.5/ton in Illinois in recent weeks. The price stabilization followed a slight seasonal increase of 1.2% reflected spring planting demand. Excess inventories from 2019 allowed anhydrous prices to remain relatively constant despite strong nitrogen demand this spring.

Input suppliers reported strong activity at anhydrous terminals as planting season kicked off, suggesting that farmers were serious about planting 97 million acres of corn. Decreased Chinese demand in the pandemic’s wake ensured anhydrous availability for the spring. But fall availability could be a different story if rising political tensions between the U.S. and China continue to escalate.

Urea & UAN: Wholesale urea and UAN prices seesawed quite a bit as planting progressed this spring. But as spring fieldwork ended in many areas, demand – and price – has fallen.

Input availability was a non-issue this spring, thanks to a lousy 2019 season. But it may not carry through to 2021. China produces 49% of pesticides used on U.S. fields. While China is poised to recover from the coronavirus pandemic ahead of Western countries, there may be an increased push towards domestic input production in the near future to mitigate availability risk. Such a shift would inevitably come at the cost of farmers as domestic manufacturing would incur higher input costs.

Thankfully, the supply chain has stood firm against obstacles created by the COVID-19 pandemic this planting season. Warehouses had significant seed and crop nutrient inventories from 2019 left over, buffering the supply chain from major shocks this spring. Ag retailers increased warehouse hours, trucking capacity, and direct shipping to minimize the chances of spreading coronavirus. The supply chain can withstand last-minute changes, but farmers may be less willing to take on that risk given uncertainties about virus transmission.

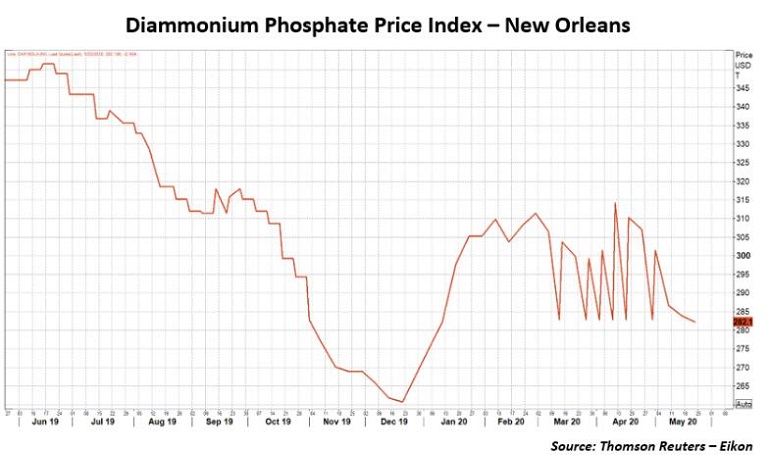

Dollar strengthens

As the coronavirus pandemic infected international markets, investors searching for “safe-haven” assets flocked to stable currencies, particularly the U.S. dollar and Japanese yen. These currencies have strengthened as a result, making U.S. products a more expensive option for potential buyers in international markets.

As the coronavirus pandemic made landfall in the U.S., the dollar index began to tank amid inaction to prevent the virus’ transmission. Lockdown measures sent the dollar skyrocketing only to face a precipitous drop in the same 10-day period as Congress fumbled early efforts to pass an initial stimulus bill. The dollar has since backed off mid-March spikes, but the constant volatility has contributed to a 3.4% rise in the ICE Dollar Index since the start of the year.

Availability may end up playing a larger factor in the attractiveness of U.S. grain to global buyers than price. As economic uncertainty continues to plague global markets amid the COVID-19 pandemic, a stronger U.S. dollar may be here to stay until a vaccine is developed – or until another round of negative economic news sends it falling.

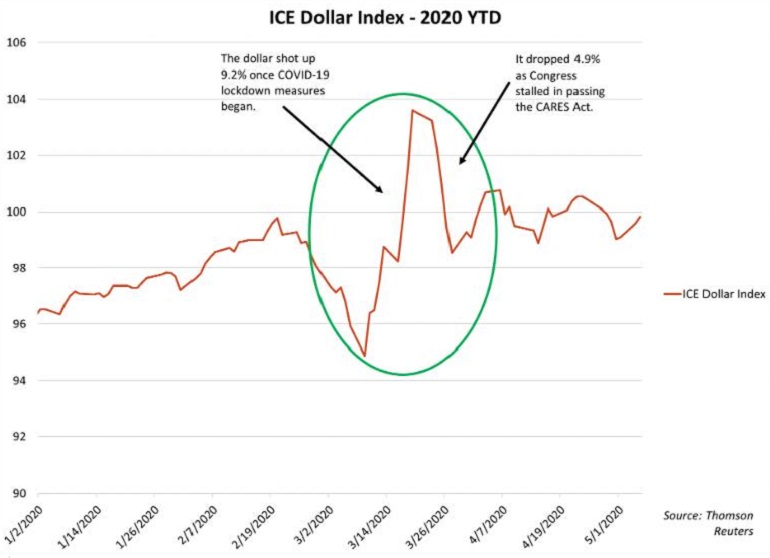

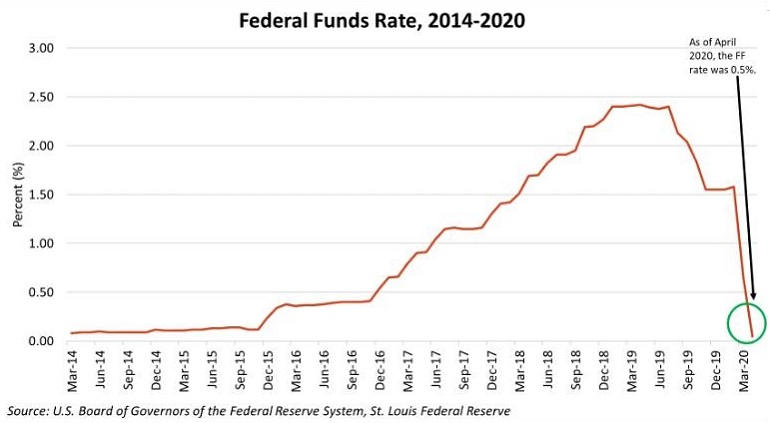

Interest rates: How low will they go?

Despite President Trump’s tweets for negative interest rates, Federal Reserve Chairman Jerome Powell has remained firm in his stance of leaving the Effective Federal Funds rate near zero. The rate dropped from 1.58% in February in a series of sharp decreases that have matched those of the Great Recession.

The Federal Reserve’s move to increase monetary supply provided some insulation against economic distress for consumers. Combined with relief programs, including the Paycheck Protection Program (PPP), the boost to credit availability enabled thousands of Americans to stave off financial ruin in the pandemic’s early days.

It may be too early to consider the long-term impacts of low interest rates and a larger monetary supply as the fallout from the pandemic continues. This is especially true as the dimmed prospect of higher economic growth in the near future curbs inflation concerns. But in the short run, it presents an opportunity for farmers looking to refinance. It is also a cheap way to ensure availability for harvest inputs, provided the cost savings is cheaper than the compounded interest expense.

Economic confidence: a serious self-esteem issue

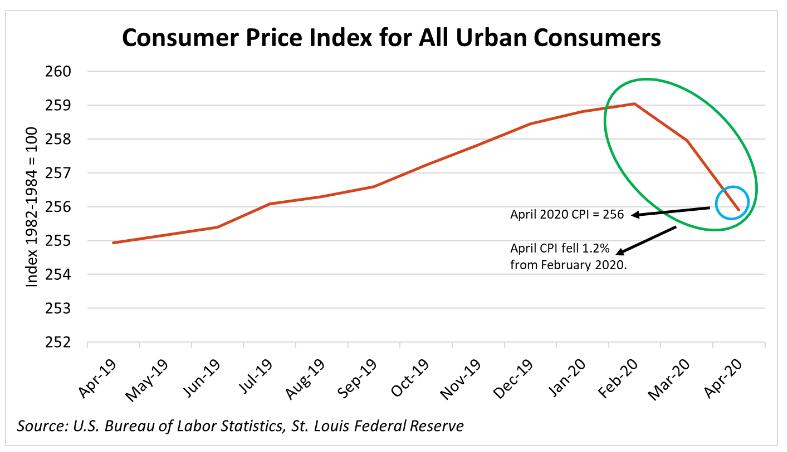

The U.S. Consumer Price Index (CPI) fell 0.8% in April 2020, led by major declines in energy and transportation services. But amid shaky consumer confidence in the economy, there was a bright spot for U.S. agriculture: The CPI’s food index grew 1.5% higher, with the largest increases in cereals and bakery products ever recorded in April. Americans will likely continue to do more cooking at home as the pandemic drags on and more Americans are out of work.

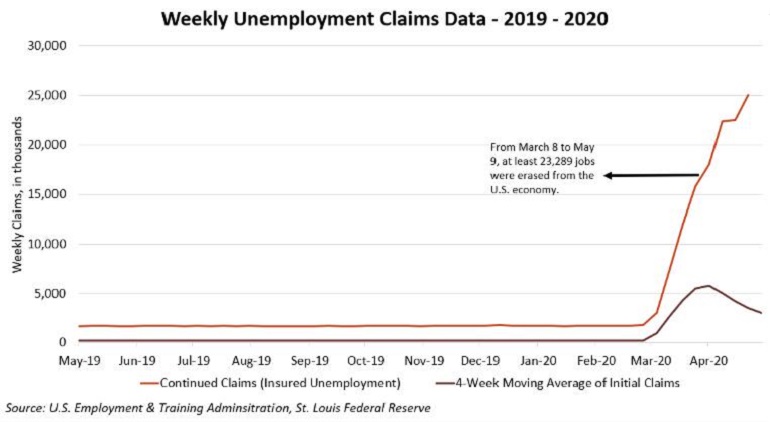

Unemployment claims reached 25.1 million last week as the U.S. economy has eliminated the same number of jobs created after the Great Recession in the weeks following the pandemic’s onset. It has yet to be determined how many of these jobs will return as the economy recalibrates in the current pandemic environment.

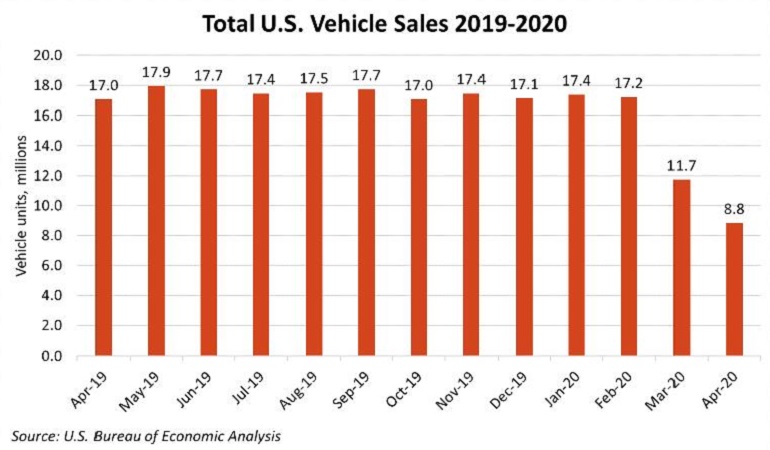

Vehicle sales ground to a halt in March as the pandemic took hold of the nation. Total vehicle sales dropped by nearly 8.4 million units between February and April as many show rooms around the country closed to prevent virus transmission. The April 2020 measurement was the lowest sale total since the U.S. Bureau of Economic Analysis began tracking vehicle purchase data since 1980.

The same consumer hesitation amidst unprecedented economic uncertainty bled over into the retail sector as well. According to the U.S. Census Bureau, restaurants and bars saw a 48.7% decline in monthly sales in April 2020 compared to a year ago. Total retail sales were down 20.6% from a year ago in April. Grocery stores were the sole source of consumer safety during lockdown as their monthly sales increased 13.2% on the year. Consumers backed off consumer stockpiling, as evidenced by a 13.1% drop in sales at grocers and liquor stores from March 2020.

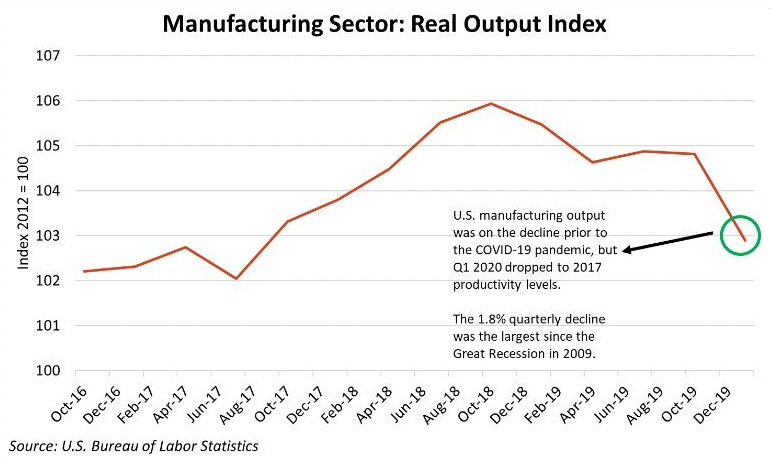

Manufacturing output data has not fully encapsulated the extent of industrial damage inflicted by the pandemic, as the most recent manufacturing data only spans to the end of March 2020. But output has declined nearly 2.9% from the fourth quarter of 2018. During the 2008 recession, manufacturing output dropped 18.4% between the end of 2007 and mid-2009. First quarter output declines this year so far were the sharpest since the Great Recession in 2008 and 2009.

.

The aforementioned economic data perfectly previews farm machinery sales this spring. In Deere & Co’s recent second quarter 2020 earnings report, the world’s largest supplier of agricultural equipment forecasted a 10-15% slump in annual farm and turf equipment sales. Even though farm equipment sales will likely main depressed in the COVID-19 era amid low commodity prices, ag sales will likely provide a buffer to Deere’s losses in their forestry and construction business units in 2020.

Parting thoughts

Most consumers fear virus transmission and are not willing to sacrifice their safety to return to pre-pandemic purchasing, as clearly evidenced by recent financial data. The economy will continue to suffer if this mental paralysis exists. But farmers could stand to benefit if the continued fear weighs on fuel, input, and financial costs.

If your farm is in a stable cash flow position and can obtain financing at record low interest rates, now is a fantastic time to leverage equity to take advantage of low input costs. Talk with your banker about the potential cost offset of input savings to short-term debt rates. If the math works in your favor, don’t hesitate to take advantage of low input costs.

Revenue projections may not be favorable right now, but that is no excuse to ignore the cost side of the profit equation. Taking proactive steps to manage costs by booking low input prices and finding new ways to trim fat on your operation will not only help farms weather the pandemic, but it will also set disciplined farms in a better position when revenues rebound.

The world is in chaos, but don’t let it overwhelm you. Think back to last fall’s harvest season and give credence to input availability at that point. Amid the current uncertainty surrounding the pandemic, do you have an opportunity to book propane right now? Does your farm have enough on-farm storage capacity to support buying cheaply priced inputs early to ensure availability for harvest?

Acting on these questions now will pay dividends in the long run. The supply chain may have operated favorably during planting, but there is no guarantee that will carry forward to fall. Diplomatic tensions between China and the U.S. have been rising as world economies attempt to reopen, which may not bode well for future fertilizer and pesticide shipments.

Now is not the time to succumb to fear. Run the numbers, be disciplined about costs, and do whatever dirty work is necessary to lock in cheaper inputs. Not only will your farm face reduced availability risk in the fall, but profit calculations will not be held down by uncontrollable costs.( from www.farmprogress.com)

Previous: Efficacy of Fulvic Acid

Next: Types of Biostimulants