Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

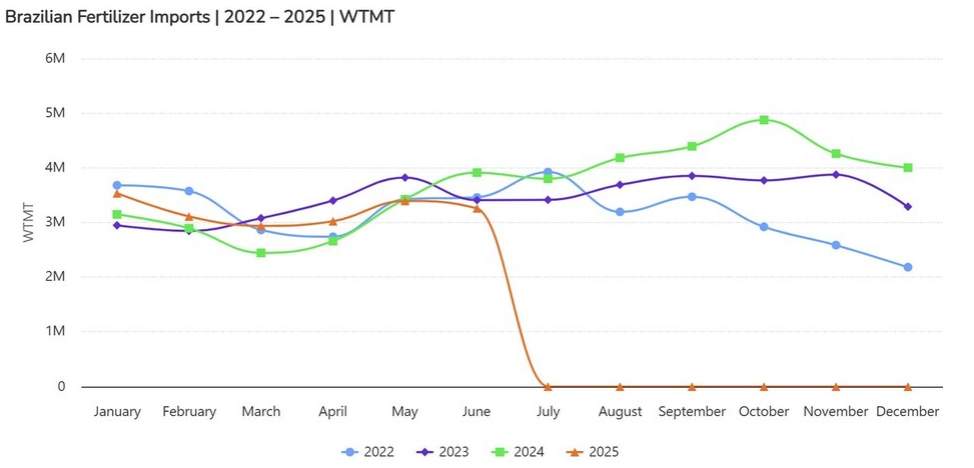

Brazil imported 4.79 million tons of fertilizers in July, the highest monthly volume of 2025, according to data from the Ministry of Industry and Foreign Trade (MDIC). The figure represents an increase of 15.6% compared to June and 7.1% compared to July 2024, setting a record for that month.

From January to July 2025, imports totaled 24.2 million tons, up 8.8% from the same period in 2024. The volume also surpassed the previous record of 23.67 million tons in 2022 by 2.2%.

Russia remained the main supplier with 6.88 million tons, representing 28.2% of the total and an 18% year-on-year increase. China followed with 5.14 million tons (21.2%), a rise of 75.7%. Canada supplied 3.1 million tons (12.8%), down 2.2%.

According to Datagro, the market was influenced by geopolitical conditions, including conflict in the Middle East and tariff disputes led by the United States. The risk of new sanctions on countries importing Russian fertilizers, including Brazil, raised concerns over supply and pushed international prices higher. The consultancy noted that producers had advanced purchases, contributing to the July figures.

Potential U.S. sanctions could affect Latin American farmers, including avocado producers in Mexico, coffee and fruit growers in Colombia, and soybean and corn producers in Brazil.

Average CIF prices rose in July. NP compounds averaged US$570.87 per tonne, up 13.2% from June and 15.9% from July 2024. Urea increased 7% to US$427.37 per tonne. MAP and KCl rose between 5% and 6%. Year to date, urea has risen 23%, MAP 23.8%, KCl 14.5%, and ammonium sulfate 6.2%.

Brazilian importers expressed concern about U.S. retaliation against Russian fertilizer imports, with some companies seeking alternative suppliers. Mosaic, based in the U.S., warned that further disruptions among major exporters could increase price volatility.

The Port of Paranaguá (PR) was the main entry point from January to July, handling 6.34 million tons (26.2% of the total). Santos (SP) followed with 3.91 million tons (16.2%), Rio Grande (RS) with 3.86 million tons (16%), São Luís (MA) with 2.31 million tons (9.5%), and Salvador (BA) with 1.61 million tons (6.7%).

Brazil spent US$8.8 billion on fertilizer imports from January to July, up 16% from the same period in 2023, reflecting both higher volumes and increased prices. Fertilizers accounted for 5.2% of Brazil's total imports in the period, compared to 4.9% a year earlier.

Datagro forecasts that 2025 is on track to reach new records in both volume and value. The consultancy added that while costs have risen, continued purchases are expected since the productivity loss from input shortages would outweigh the price increases.

Source: DatamarNews