Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

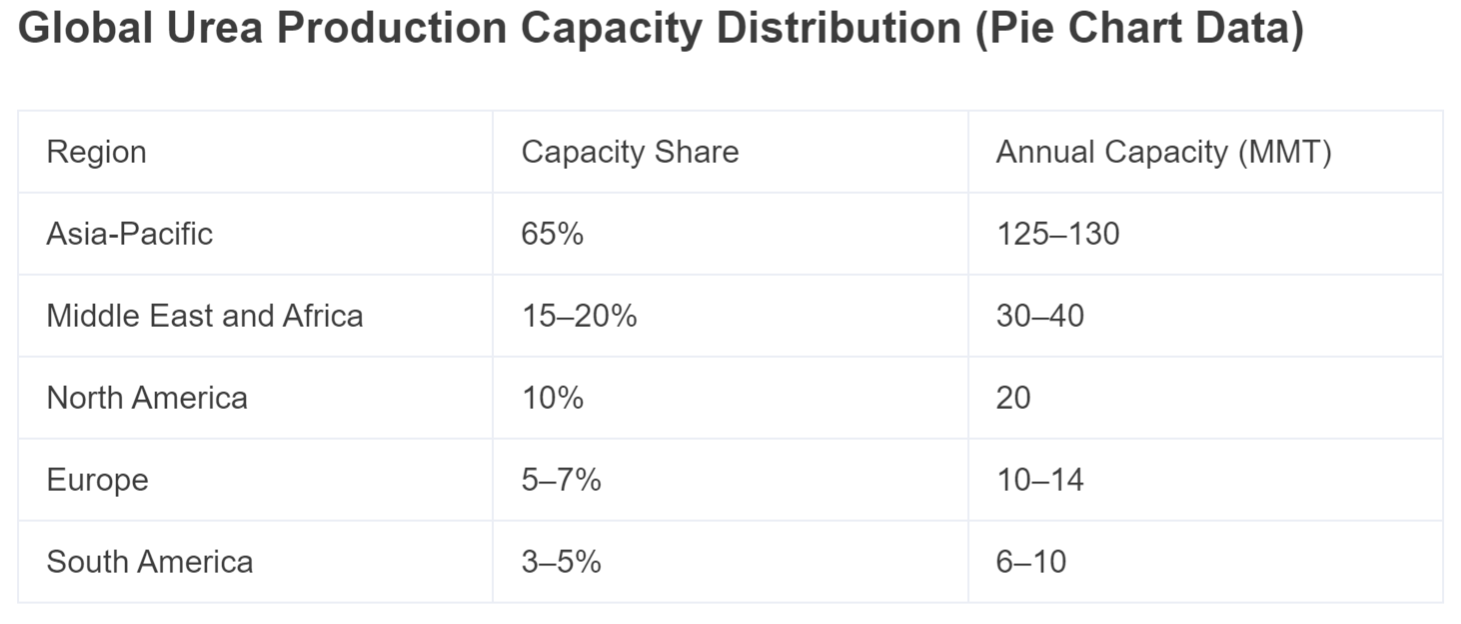

The global urea production capacity is unevenly distributed, with key regions and countries dominating due to access to raw materials (ammonia and natural gas), infrastructure, and agricultural demand. As of recent data, the total global urea production capacity is approximately 192–200 million metric tons (MMT) annually, with projections to increase in the coming years. Below is a breakdown of the distribution based on available information:

· Asia-Pacific (65% of global capacity, ~125–130 MMT):

· China: The largest producer, accounting for roughly 30–35% of global capacity (~60–70 MMT). China’s production has been declining slightly due to environmental policies, dropping to 63.9 MMT by 2022.

· India: A major producer and consumer, with a capacity of ~31 MMT in 2024, aiming for 32.5 MMT by 2025. India is pushing for self-sufficiency, reducing import reliance.

· Indonesia, Japan, South Korea: Significant contributors, driven by agricultural demand and industrial applications.

· The region’s dominance is due to high agricultural activity, population growth, and government support for fertilizer production.

· Middle East and Africa (~15–20% of global capacity, ~30–40 MMT):

· Saudi Arabia: A key exporter with substantial capacity, benefiting from abundant natural gas. Major players like SABIC contribute significantly.

· Qatar: Hosts large-scale facilities like Qatar Fertiliser Company, adding to the region’s export capacity.

· Egypt: Capacity of ~6–7 MMT, with disruptions noted in 2025 due to natural gas import issues.

· Nigeria: Emerging capacity with projects like the Dangote Urea Plant (3 MMT), set to boost local and export supply.

· The region is expanding due to investments in new plants and growing agricultural demand in Africa.

· North America (~10% of global capacity, ~20 MMT):

· United States: Major producers like CF Industries and Nutrien operate large facilities, with expansions planned (e.g., Nutrien’s 1 MMT increase by 2025, CF Industries’ 2.5 MMT plant by 2025).

· The region focuses on reducing import dependency and meeting domestic agricultural needs.

· Europe (~5–7% of global capacity, ~10–14 MMT):

· Russia: A significant producer (~10 MMT), though exports face geopolitical challenges.

· Norway: Yara International operates multiple plants, contributing to Europe’s supply.

· Europe’s capacity is constrained by high energy costs and environmental regulations, leading to reliance on imports.

· South America (~3–5% of global capacity, ~6–10 MMT):

· Brazil: Expanding capacity with projects like Yara’s 3.6 MMT plant by 2025.

· The region is a growing market due to agricultural expansion but relies partly on imports.

Future Trends in the Urea Market

The global urea market is projected to grow steadily, driven by agricultural demand, industrial applications, and technological advancements. Below are key trends shaping the market through 2032–2035:

1. Market Size Growth:

· The market was valued at ~USD 72.5–128.9 billion in 2023–2024, with projections to reach USD 99.3–160.67 billion by 2032–2033 (CAGR of 1.5–6.98%) or 276 MMT by 2035 (CAGR of 3.97%).

· Growth is driven by rising food demand due to a global population projected to reach 9.7 billion by 2050, increasing the need for nitrogen fertilizers.

2. Agricultural Demand as Primary Driver:

· Fertilizer-grade urea dominates (~72–78% market share in 2025), driven by its high nitrogen content (46%) for crops like wheat, maize, and rice.

· Developing regions (Asia, Africa) will see higher demand due to population growth and limited arable land, necessitating high-yield fertilizers.

3. Capacity Expansions:

· Significant investments include EuroChem’s 1.4 MMT plant in Russia (2026), Yara’s 3.6 MMT plant in Brazil (2025), and Nutrien’s 2.8 MMT plant in the US (2024).

· Nigeria’s Dangote plant and India’s push for self-sufficiency (e.g., nano liquid urea) will boost regional capacities.

· Global capacity is expected to rise by 6% to 202 MMT by 2027.

4. Sustainability and Innovation:

· Eco-friendly formulations like slow-release, bio-based, and nano liquid urea are gaining traction to reduce nitrogen loss and environmental impact.

· Innovations like Egypt’s black urea (25–30% less nitrogen) and blue urea (using renewable energy) aim to meet sustainability goals.

· Stricter environmental regulations are pushing investments in low-emission production technologies.

5. Industrial and Environmental Applications:

· Urea use in automotive selective catalytic reduction (SCR) systems (e.g., AdBlue) is growing due to emission regulations, particularly in Asia-Pacific and Europe.

· Industrial applications (e.g., urea-formaldehyde resins, bioplastics) are expanding, with construction and chemical sectors contributing ~15–25% of demand.

6. Price and Supply Chain Dynamics:

· Urea prices fluctuated in 2024–2025, reaching USD 390/MT in the US and USD 362/MT in Saudi Arabia by mid-2025, driven by supply disruptions (e.g., Egypt’s plant shutdowns) and agricultural demand.

· Geopolitical issues (e.g., Russia-Ukraine conflict, Middle East tensions) and US tariffs on petrochemicals may disrupt supply chains and increase prices.

· Forecasts suggest a price decline to USD 325/MT by 2025 due to increased capacity, though volatility persists.

7. Regional Trends:

· Asia-Pacific: Will maintain dominance (65% market share in 2025) due to agricultural demand and government subsidies (e.g., India’s USD 2 billion fertilizer subsidy).

· Middle East & Africa: Fastest-growing region due to capacity expansions and agricultural development in Nigeria, Egypt, and Algeria.

· North America: Steady growth (CAGR 3.8%) with focus on domestic production and sustainable practices.

· Europe: Faces challenges from high energy costs and geopolitical export constraints but benefits from Yara’s innovations.

8. Challenges:

· Environmental concerns over nitrogen emissions and soil health are pushing for alternatives, though urea remains dominant.

· Supply chain disruptions (e.g., Russia’s export issues, Egypt’s gas shortages) and tariffs may create short-term price volatility.

· Overcapacity in some regions (e.g., China) could depress prices, impacting producers’ margins.

Conclusion:The global urea production capacity is concentrated in Asia-Pacific (led by China and India), followed by the Middle East, North America, Europe, and South America. The market is poised for steady growth through 2035, driven by agricultural demand, capacity expansions, and emerging applications in automotive and industrial sectors. Sustainability trends, such as bio-based and slow-release urea, will shape future production, while geopolitical and supply chain challenges may cause price volatility. Investments in new plants and technologies will likely ensure supply growth, particularly in developing regions.