Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

Exhibition time: 17-19 March, 2026 Shanghai, China

中文

中文

1. Due to the environmental protection policy, there is less phosphate ore

Phosphate ore is one of the main raw materials for yellow phosphorus production. China's phosphate ore production reached its peak in 2015, with an annual output of 130 million tons, but there are problems such as disorderly mining, mainly small and medium-sized enterprises, low resource utilization, and greater environmental damage. Therefore, strengthening the governance and rectification of phosphate mines has been one of the heavy punches of environmental governance in China in recent years.

Under the policy of environmental protection and production restrictions, China's phosphate ore production has declined significantly, with negative growth in production from 2016 and a negative growth rate of -27.9% in 2018, with production falling below 100 million tons for the first time to 96,326,000 tons, and the current production still maintains a downward trend.

From the perspective of the four major production areas, Sichuan had the largest drop of 50%, followed by Guizhou with a drop of 29% and Hubei and Yunnan with a drop of 25%.

Last year, domestic phosphate ore production fell to 89 million tons.

2. Lithium iron phosphate batteries

This year, the red-hot downstream applications market has also driven up the yellow phosphorus market. Relative to the traditional market, back to the battery industry C lithium iron phosphate is a more powerful support for the yellow phosphorus market this year.

Lithium iron phosphate and ternary lithium batteries are the two main technical routes of power batteries. Ternary lithium batteries due to high energy density in the market these years, while lithium iron phosphate batteries are known for lower cost and higher safety.

By the end of last year, China's lithium iron phosphate and ternary lithium battery production accounted for 41.4% and 58.1% respectively.

As of May this year, the cumulative production of lithium iron phosphate has reached 50.3%, more than 49.6% of ternary lithium batteries.

And this year will be a big year of growth in demand for lithium iron phosphate, is expected to grow 80% year-on-year

3. Yellow phosphorus enterprises and power restrictions

China's yellow phosphorus production areas are concentrated in the southwest region of Yunnan, Sichuan, Guizhou and Hubei 4 provinces.

The southwest region is dominated by hydropower. This year, the dry period in Yunnan is longer than in previous years (December to May).

On May 10, Yunnan Power Grid issued a notice of emergency peak preparation, stating that there was a power gap of about 700,000 kilowatts at the peak of electricity consumption that day, and therefore began to stagger power restrictions for local power-using enterprises in various states. in mid-to-late May, as the severe situation of power supply could not be alleviated, Yunnan's power restrictions escalated again, and most yellow phosphorus enterprises were forced to reduce load production and stagger production. It is reported that in the middle and late July, the daily production of yellow phosphorus in Yunnan was about 500 tons, and the start-up rate dropped 20 percentage points to 31%, and the domestic inventory was only 750 tons, down 55.9%, so the market supply was very tight.

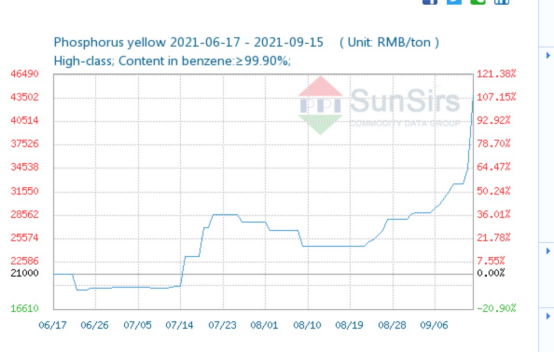

In this context, domestic yellow phosphorus prices since mid-May began to rise linearly, the current yellow phosphorus spot market is basically no inventory, the market supply tension intensified, is expected to continue to stimulate the yellow phosphorus prices in the short term to maintain an upward trend.

Previous: Brown Algae Polyphenols